Cannabis Tax Reporting Guide

Below is information regarding reporting cannabis sales tax to LCB. Cannabis retail licensees are required to submit a Retailer Sales and Tax report their monthly sales, even if they have no sales, by the tax due date each month. For additional questions or further assistance, please contact the Cannabis Tax Unit at (360) 664-1789.

What can you do to avoid your account becoming past due?

- Know your tax reporting and payment responsibilities (e.g., tax due date) by looking at the Filing Due Date section below.

- Mark your calendar with the tax due date. Submit your report and payment before that date to avoid being assessed late payment penalties and to ensure your payment is received on time.

- We communicate by email, phone, and by mail if needed. Check your email and voicemail for messages from LCB Tax and Fee Unit. Respond quickly to questions, missing report notices, and send in your payment as soon as you get our courtesy, balance-due statement.

- Keep your contact information current (e.g., telephone numbers, mailing, and email address).

- Review and update your phone number if it is not current. Make sure you set up your voicemail box and check that it is not full.

- Send an email to licensingchanges@lcb.wa.gov with license information and what should be updated or call our Licensing Customer Service staff at (360) 664-1600 (option 1) for assistance.

- Contact the Tax and Fee desk at cannabistaxes@lcb.wa.gov or (360) 664-1789 if you have questions.

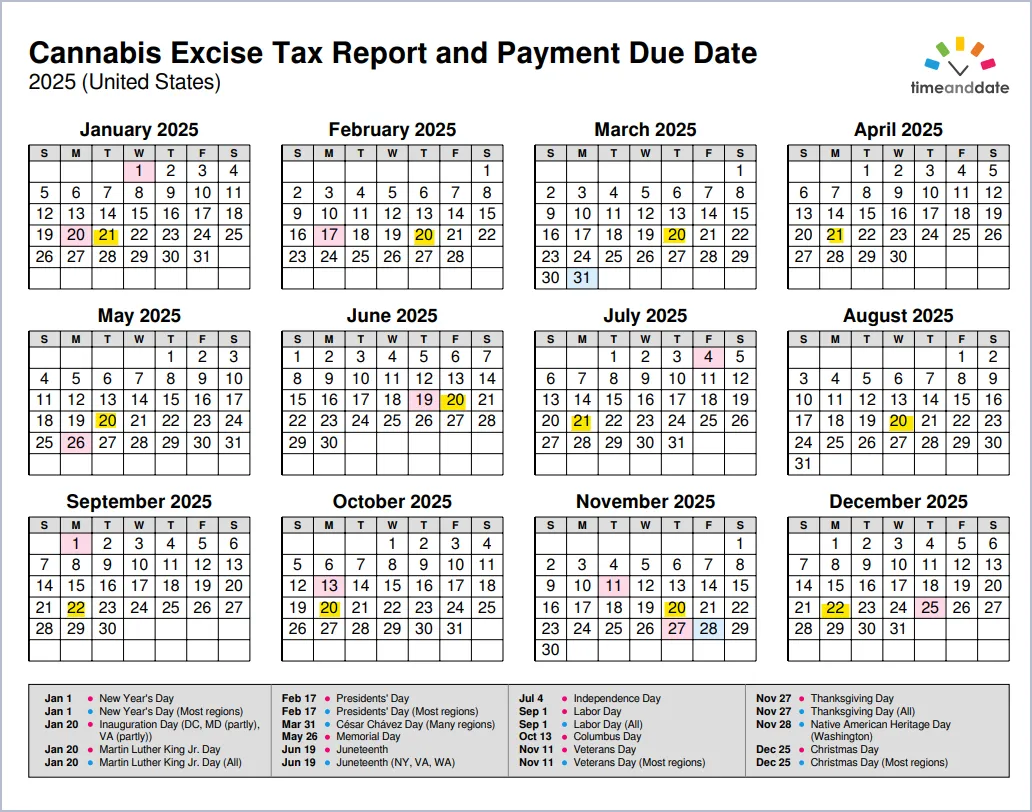

Filing Due Dates

Cannabis reporting and payment due dates are in yellow. Reports and payments are due on or before the 20th of the next month following completed sales. If the 20th falls on a weekend or a holiday, the next business day is the tax due date.

Statutory Rules and WACs

- RCW 69.50.535

- Cannabis excise tax, reports, state and federal anti-trust laws.

- RCW 69.50.565

- Unpaid trust fund taxes, liabilities and administrative hearings.

- WAC 314-55-087

- Recordkeeping requirements for cannabis licensees.

- WAC 314-55-089

- Tax and reporting requirements for cannabis licensees.

- WAC 314-55-090

- Medical cannabis patient excise tax exemption.

- WAC 314-55-092

- Failure to pay excise taxes and late payment of excise taxes.

Retail Licenses – Monthly Sales / Cannabis Excise Tax Reporting

Cannabis retail licensees are required to submit a retailer sales and tax report of their monthly sales, even if they have no sales, by the tax due date each month.

Licenses must report:

- Total cannabis product sold (including medical products).

- Total exempt medical products sold.

- Additional collected cannabis excise tax that cannot be returned to the buyer.

Your report and the collected cannabis excise tax payment must be received, or postmarked if mailed, no later than the tax day each month to avoid the 2% late payment penalty. If there is not a postmark or a legible postmark on the payment envelope, the date received by the LCB will be used.

Recreational Cannabis Excise Tax

There is a levied 37% cannabis excise tax collected by licensed cannabis retailers from consumers at the time of purchase. Retailers are responsible for paying uncollected excise tax if the tax rate is not correctly set-up in their systems.

Medical Cannabis Exemption

Effective June 6, 2024 (ending June 30, 2029), there is a medical cannabis tax exemption. The excise tax levied in RCW 69.50.535(1) does not apply to sales of cannabis that satisfy all the following conditions.

- The sale is made by a licensed cannabis retailer holding a valid medical cannabis endorsement.

- The sale is made to a qualifying patient or their designated provider with a valid recognition card issued by the Washington State Department of Health (DOH).

- The sale is of cannabis concentrates, useable cannabis, or cannabis-infused products identified by DOH as a compliant cannabis product in chapter 246-70 WAC and tested to the standards in chapter 246-70 WAC.

Cannabis retailers may be assessed the 37% cannabis excise tax if:

- They do not have an active medical endorsement. This will be checked each month there are medically compliant sales reported to the LCB.

- The consumer did not have an active recognition card. If during an audit it is found that the consumer provided a fraudulent card, or the card was not active.

- The sale of the cannabis product did not meet the “DOH” medically compliant product as shown in their rule 246-70.

The 2% late payment penalty may be assessed if the payment is received after the tax due date for that reported month.

Cannabis Retailer Sales and Tax Form

Below are the Cannabis Retailer forms, which have been revised to include medical cannabis product sales in June 2024. Cannabis retail licensees are required to a Retailer Sales and Tax report their monthly sales, even if they have no sales, by the tax due date each month. Your report and the collected Cannabis excise tax payment must be received, or postmarked if mailed, no later than the tax day each month to avoid the 2% late payment penalty.

How to Submit Cannabis Retailer Tax Report (LIQ1295) Guide

Please download the cannabis retailer report forms below:

Reporting of medical cannabis exempted sales will start with the June 2024 Cannabis Retailer monthly sales/tax report due July 22, 2024. Cannabis retailers that do not have an active medical endorsement will be notified by email, they do not qualify for the exemption and will be assessed the 37% cannabis excise tax on the claimed medical cannabis product sales. To avoid being assessed the 2% late payment penalty on the account balance, payment will be due by the tax due date.

For further assistance with cannabis tax reporting, please refer to the Cannabis Tax Reporting Guide.

Reporting sales / excise tax differences

If you collected more taxes than calculated from a cannabis buyer, you are required to either refund the amount to the buyer or report the over-collection using the Retailer Sales and Tax Form, cell 8, and submit the form and additional taxes to WSLCB by the tax due date of the following month.

Revising Your Monthly Sales / Tax Report

To revise a previously submitted report - email the completed Retailer Sales and Tax Form to cannabistaxes@lcb.wa.gov.

Please note – we will only accept revised reports with credits for the last 24 months of business.

The following information is required before we will start our review of the revised reports:

- The original report and supporting point of sale report. Write on the document "Original.”

- The revised report (check the box for revised) and supporting point of sale report.

- Brief explanation for the revised report.

Once your information has been accepted, allow 10 business days for our review.

The LCB Finance Auditors may be requested to review your report and documents before our Finance Tax and Fee division will accept a revised report.

Payments

Requirements and Options

To be compliant, your monthly sales/tax report and payment are to be submitted on or before the tax due date using our Cannabis Retailer Sales and Tax Form. Your point-of-sale provider/integrator's monthly sales report will not satisfy this requirement. Your license can be suspended and/or revoked if you are not fully compliant.

ACH Payments

The date you submit your payment request to the bank’s payment portal (Retail Lockbox) is the payment date entered in our system. You are not able to “schedule your payment” in this system. Please email your completed report (Retailer Sales and Tax Form) to cannabistaxes@lcb.wa.gov.

Make Your Payment Through CCRS

Click here for step-by-step instructions on creating an online payment request in CCRS. For information on making an administrative payment through CCRS, access the Administrative License Guide on the CCRS Resources page.

When using the CCRS “Make a Payment” link, your license number and current date are updated by the system. You will need to add:

- Payment amount.

- Contact date (name, phone number and email).

- Banking (routing and bank account) number.

Before submitting your request, review the “check” to ensure your information is correct. Once the request is successfully submitted, a payment receipt is sent to the email address that was entered.

Email your monthly sales/tax report to cannabistaxes@lcb.wa.gov. It is suggested you email your report the same day you submit your payment through CCRS.

Mailing Reports and Payments

Mailed reports must be post marked on or before the due date to be on time. To ensure a postmark date, we suggest that you go into the post office and request they date stamp the envelope. Please include a copy of your monthly sales/tax report when mailing your payment.

You are not required to email your completed monthly sales/tax report, if you are mailing it with your payment.

Mail your payment to:

Washington State Liquor and Cannabis Board

PO Box 3724

Seattle WA 98124-3724

The 2% late payment penalty will be accessed on the account balance after the tax due date. When the due date falls on a Saturday, Sunday, or holiday, the payment envelope must be postmarked by the U.S. Postal Service no later than the next business day.

No postmark, non-legible postmarks, postmarks that are difficult to read (light, blurred or incomplete), partially off the envelope so the date cannot be read, and received after the tax due date will be considered late and will be assessed a penalty. If the payment envelope does not have a post-mark date, the date received by the “LCB” is used.

To insure your account receives credit for your payment please have your license number listed on the check, ensure the number amount and the written legal line match and sign your check. We will return your check if the legal line is blank, incorrectly completed or not signed.

Paying in Person

Your tax obligation can by paid by check, cashier check or money order, at the front desk, Tuesday through Thursday (excluding holidays) from 8:00 a.m. to 4:50 p.m.

When paying at the front desk, include a paper copy of your tax report with your payment. To avoid processing delays of your payment, please ensure your license number is on the check.

Paying in Person Other Than by Check, Cashier Check or Money Order

An appointment is required, and you must have an approved and active waiver. Appointments are scheduled (at least 24 hours in advance) and only on the tax due date. Additional instructions are included in our monthly notice to those approved to pay using the payment room.

You may still pay in person without an approved waiver but will be assessed a 10% penalty for failing to follow written instructions.

Cannabis Payment Waiver

Payments by means other than ACH/EPAY, check, cashier’s check, or money order requires an approved payment waiver.

Request for waivers are to be submitted in writing by email or USPS, along with copies of one of the following documents:

- Bank account application.

- Bank account denial letter.

- Bank account cancellation letter.

- Other information that would support your inability to get a bank account.

Your documentation must be dated within the last 90 days. If from a bank or credit union, include their name and address.

Waiver requests can be by email to cannabistaxes@lcb.wa.gov or standard mail to:

Washington State Liquor and Cannabis Board

Financial Division

PO Box 3724

Seattle WA 98124-3724

Waiver requests take a minimum of three business days to process. Waiver request received on the tax due date will be processed after the tax due date.

Record Keeping

Keep your paper and electronic business records for a minimum period of six years (current year plus previous five years). You may be required to retain records for longer periods to meet the requirements of other Washington agencies or to meet federal requirements.

Financial records include but are not limited to:

- Purchase invoices and supporting documents,

- Bank statements and cancelled checks for any accounts related to the business,

- Accounting and tax records related to the business and any true party of interest,

- Contracts / agreements for services performed,

- Employee records,

- Inventory records, records of theft, donated products,

- Detailed sales records, etc.

Retailers providing the medical cannabis excise tax exemption should keep the following records for every sale where the medical cannabis excise tax exemption is being provided:

- Date of sale,

- Sales price of cannabis concentrates, useable cannabis, or cannabis-infused products identified by the Department of Health as a medically compliant cannabis product in chapter WAC 246-70-040,

- Unique identifying authorization card number of the qualifying patient making the purchase,

- Stock keeping unit (SKU) of cannabis concentrates, useable cannabis, or cannabis infused products identified by the department as a compliant cannabis product in WAC 246-70-040 and tested to the standards in WAC 246-70-040.

Auditing

Finance Tax and Fee review of your reports or data does not prevent LCB from assessing additional taxes in the future. The agency reserves the right to review your complete business accounting records through its regular audit process. You are required to keep your records on the licensed premises for a six-year period (current year plus prior completed five -years) and they be available for inspection if requested by an LCB employee.

LCB Cannabis Examiners

Send questions regarding changes to inventory, manifest, incorrect sales and transfers by email to the Cannabis Examiners at examiners@lcb.wa.gov or (360) 664-1614.

Cannabis Central Reporting System

Find up-to-date information on the CCRS Resources Page.