Filing Online Tax and Fee Reports

Benefits of Online Reporting

Online tax and fee reporting and payment provide many benefits:

- 24/7 availability

- Fast and efficient

- Automatic calculations provide increased accuracy

- Helps you avoid mistakes by flagging potential errors

- Safe and secure payment by E-check through US Bank

- Quick and easy access to previously filed reports

- Instantly receive verification that your payment was received

- No payment fee

- Save the cost of envelopes and postage

- Remove the chance of your report getting lost or delayed in the mail

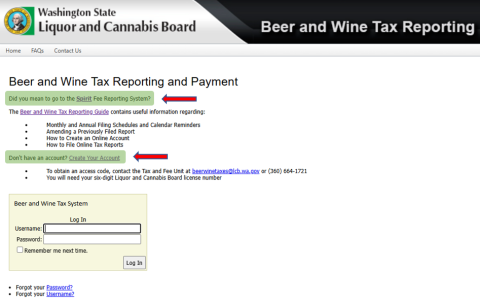

Contact the Tax and Fee Unit to obtain an access code to create your account.

Beer and Wine Taxes

beerwinetaxes@lcb.wa.gov

(360) 664-1721

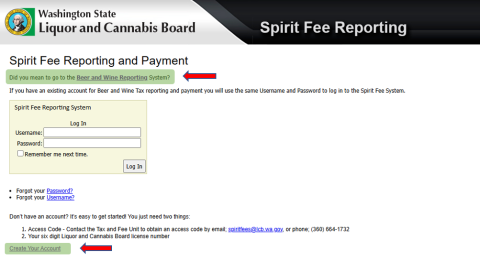

Spirit Fees

spiritfees@lcb.wa.gov

(360) 664-1732

Already have an access code?

How to Set Up a Tax and Fee Account

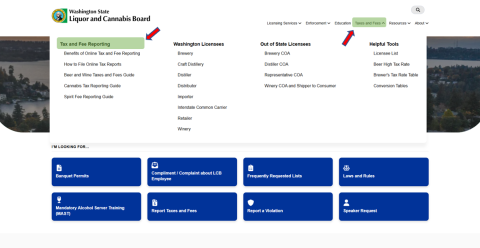

Step 1: From lcb.wa.gov, under “Taxes and Fees” click on “Tax and Fee Reporting."

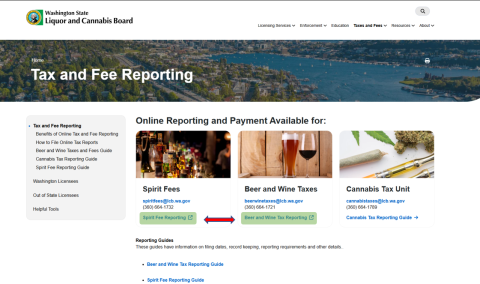

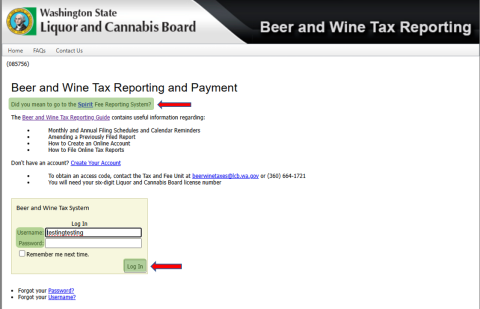

Step 2: Click on “Beer and Wine Tax Reporting” or “Spirit Fee Reporting,” depending on license type.

Step 3: Click on “Create Your Account”

Note: To switch to Spirit Fee Reporting System, click on “Did you mean to go to the Spirit Fee Reporting System?”

Note: To switch to Beer and Wine Reporting System, click on “Did you mean to go to the Beer and Wine Reporting System?”

Step 4: Using your 6-digit LCB license number and 8-character access code (received in Welcome Letter or on request) complete all fields and click “Create User."

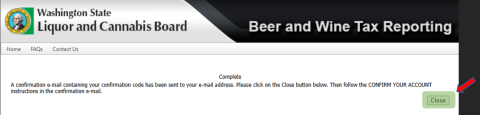

Click "close."

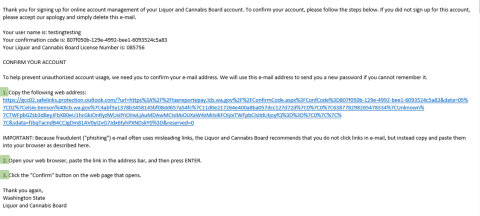

Step 5: Open the Registration Confirmation email from do-not-reply@lcb.wa.gov and follow the instructions.

Note: If you don’t see the email in your inbox, please check your junk/spam folder.

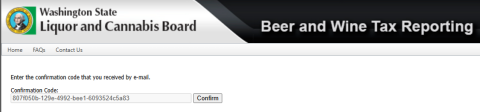

Step 6: Enter Confirmation Code and Click “Confirm.”

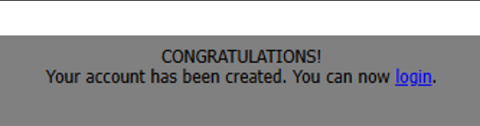

Click "login."

Step 7: Now you can login using the username and password you created.

Note: To switch to Spirit Fee Reporting System, click on “Did you mean to go to the Spirit Fee Reporting System?”

How to File Online Tax Reports

Follow the steps to guide you through the entire Epay process. At the end, you will have three options to submit your completed form.

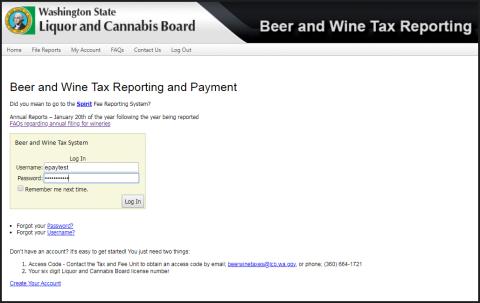

Step 1: Log in to your online account

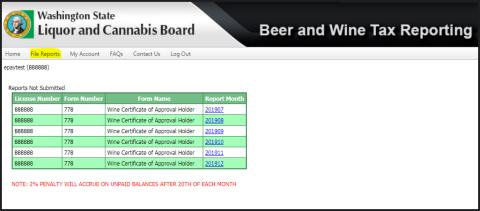

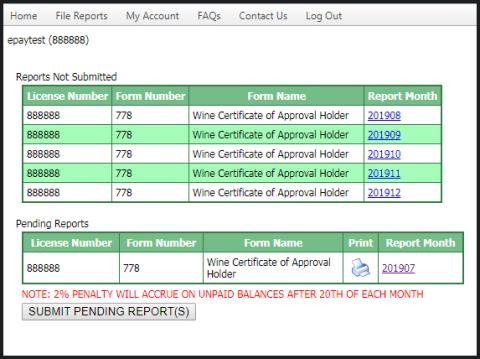

Step 2: Select “File Reports” and click the blue link for the month you want to file

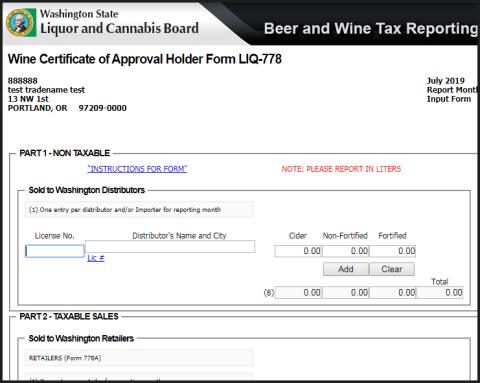

Step 3: File your report with the appropriate activity

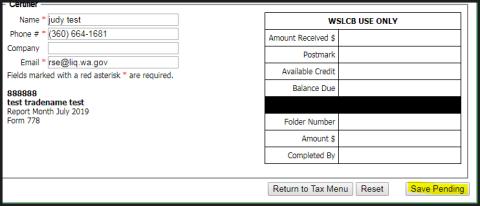

Step 4: Click “Save Pending” when you are finished. This will bring you back to the File Reports tab.

Step 5: You will now have a Pending Reports section. Select “Submit Pending Report(s).”

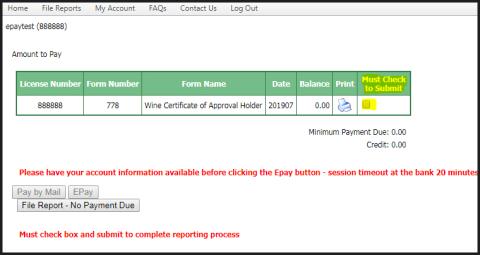

Step 6: Check the box highlighted in the image.

Then select one of three options:

- Pay by Mail

You will mail in a check for payment due. This will leave your report in pending status and we will be able to apply payment when it is received

- Epay

This will take you to the bank site where you can pay online. Please be ready to complete the process before clicking the button. Once you have started the process it locks the report, if you need to restart contact the Beer Wine Tax Desk and they can reset the report.

Note: Please have your account information available before clicking the Epay button, sessions time out after 20 minutes.

- File Report

This is for zero activity or zero balance reports. It will immediately move the report to completed status.

Step 7: Once your report is completed it will be viewable in the completed section

Note: A report submitted through Epay will show here too, but will not be completed until the bank has processed payment.