Updates for Spirit Craft Distillers and Distillers

Washington Craft Distillers and Distillers who provide adulterated samples are required to submit annual information on tasting room sales by January 25, 2024. The report must be submitted on form LIQ-1431 and covers the previous year’s tasting room sales. This report is a requirement of RCW 66.24.140 and WAC 314-28-065.

The information required was briefly part of the forms LIQ-112 and LIQ-160 for Craft Distillers and Distillers until those forms were discontinued and no longer required monthly. The sales data has been relocated to the new LIQ-1431 annual report.

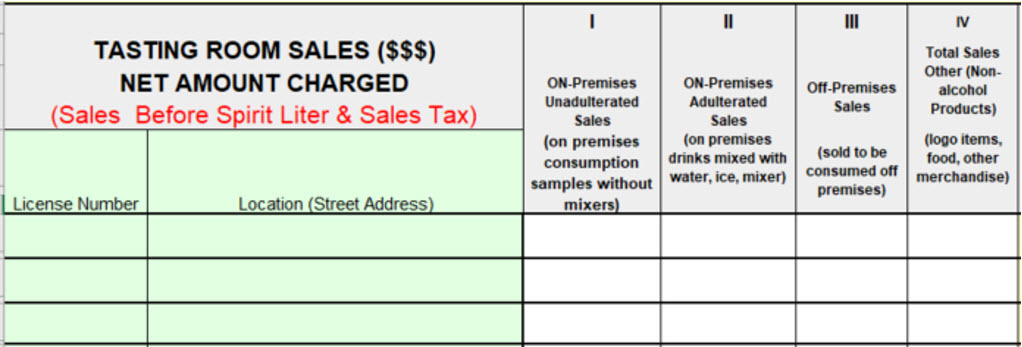

Example of report:

Distillers and Craft Distillers may serve samples of spirits free or for a charge, and may sell servings of spirits, vermouth, or sparkling wine produced in Washington for on-premises consumption at their distillery or off-site tasting rooms. Unadulterated samples must be half an ounce or less of spirits, with a two ounce per person daily limit. Any additional samples or servings for on-premises consumption must be adulterated with water, ice, mixer, or other alcohol. Selling adulterated samples is allowed only if revenue derived from the sale does not constitute more than 30 percent of the gross annual revenue earned in the tasting room. See WAC 314-28-065.

Licensees selling adulterated samples must submit an annual report on form LIQ-1431.

How to Report:

Your completed form LIQ-1431 may be submitted electronically using the On-Line Reporting System in the same manner as the monthly reporting. Please contact the Spirit Fee Unit at spiritfees@lcb.wa.gov or (360) 664-1732 if you need assistance with online reporting.

For questions on the form and reporting requirement, please contact EnfCustomerService@lcb.wa.gov or (360) 664-9878.

Additional resources can be found in the Tax and Fee section of our website at lcb.wa.gov.